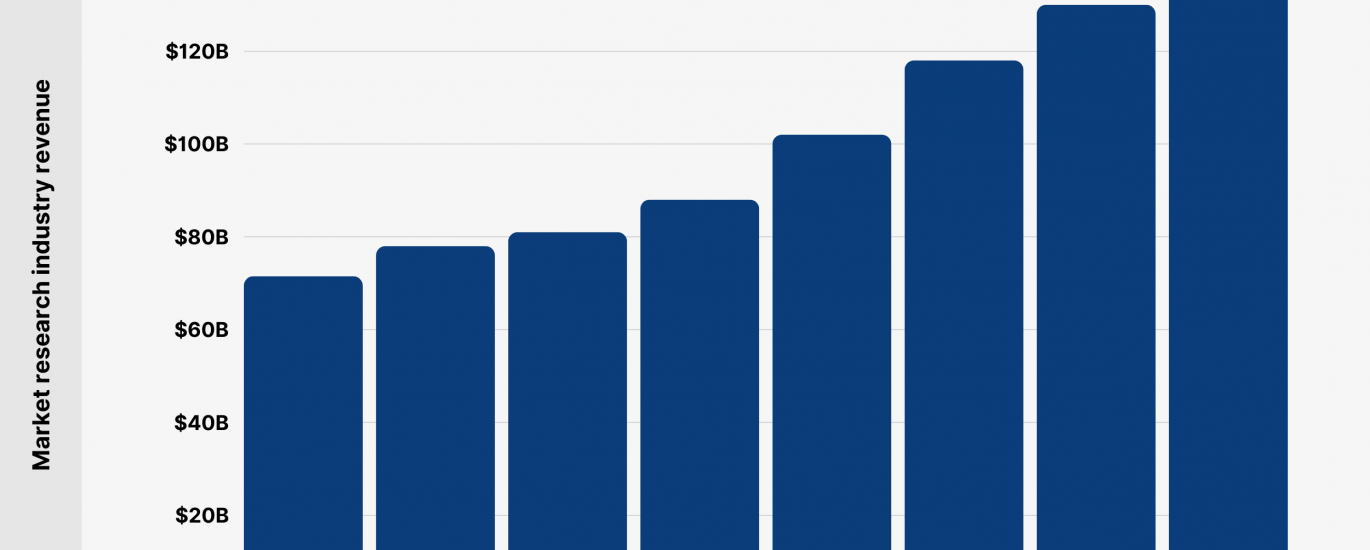

Market research is a growing multi-billion-dollar industry.

Brands leverage market research insights to introduce customer-focused offerings and improve their experiences.

From mobile-first surveys to social media analytics, researchers have access to a growing toolkit helping companies make data-driven business decisions.

Here’s a breakdown of what you’ll find on this page:

Market Research Industry Statistics

Market Research Methods Statistics

AI in Market Research Statistics

Market Research Statistics (Highlights)

The global market research industry is forecasted to bring in $140 billion in revenue in 2024.

Online/mobile quantitative research services accounted for 35% of worldwide revenues of market research companies.

Around 47% of researchers worldwide state that they use AI regularly in their market research activities.

Online surveys rank as the most used quantitative method among market research professionals with 85% of respondents who say they use this method regularly.

Online in-depth interviews with webcams rank as the most used qualitative research method, with over one-third (34%) of researchers using it regularly.

1. Market Research Industry Statistics

This section presents key statistics to show market research industry revenues, leading players in the industry and revenue breakdown by market research services.

Global market research industry forecasted to generate $140 billion in revenue in 2024 (up from $130 billion in 2023) – ESOMAR

Note: Includes data from multiple sources (ESOMAR 1, ESOMAR 2, ESOMAR 3, Consultancy.org)

Year

Market research industry revenue (worldwide)

2016

$71.5 billion

2017

$78 billion

2018

$81 billion

2019

$88 billion

2021

$102 billion

2022

$118 billion

2023

$130 billion

2024

$140 billion

Between 2021 and 2024, the market research industry grew by 37.25% from $102 billion to $140 billion – ESOMAR

When ranked by market research turnover, the US market leads the ranking with $48 billion, followed by the UK ($9.1 billion) and China ($2.88 billion) – ESOMAR

Note: Data as of 2021

Country

Market Research Turnover

United States

$48 billion

United Kingdom

$9.1 billion

China

$2.88 billion

India

$2.2 billion

France

$2.12 billion

Germany

$2.11 billion

Japan

$2.04 billion

Australia

$753 million

Canada

$606 million

Italy

$586 million

Spain

$555 million

South Korea

$507 million

Gartner holds the top position as the highest-earning company in the market research field with $5.48 billion in research revenue in 2022, followed by IQVIA ($5.43 billion) and Salesforce ($4.52 billion) – Statista

Company

Research Revenue (2022)

Gartner

$5.48 billion

IQVIA

$5.43 billion

Salesforce

$4.52 billion

Adobe Systems

$4.42 billion

Nielsen

$3.55 billion

Kantar

$2.72 billion

Ipsos

$2.53 billion

Circana (IRI+NPD)

$2.21 billion

CoStar Group

$2.18 billion

S&P Global (IHS Markit)

$1.97 billion

Online/mobile quantitative research services contributed 35% to the worldwide revenue of market research companies in 2022. Other major revenue contributors include reporting (20.2%), online traffic/web analytics (9.7%), online/mobile qualitative research (6%) – Statista

Type of Market Research Service

Revenue Share

Online/mobile quantitative research

35%

Reporting

20.2%

Online traffic/web analytics

9.7%

Online/mobile qualitative research

6%

Telephone CAITI

3.6%

Online research communities

2.8%

Social media monitoring

2.7%

Automated digital/electronic

2.7%

Face-to-face group discussions/focus groups

2.6%

Face-to-face

2%

In-depth face-to-face interviews

2%

Other qualitative

1.7%

Other quantitative

1.7%

Audience measurement

0.9%

Traditional ethnography

0.8%

Other

0.4%

2. Market Research Methods Statistics

There’s a growing number of market research methods from traditional surveys to eye tracking available to market research professionals. In this section, we’ll cover recent stats on most used market research methods.

According to a survey, 87% of market researchers worldwide state that at least half of their qualitative research is carried out remotely or online – Qualtrics

Region

Qualitative Research Conducted Online (50% or more)

Asia-Pacific and Japan

84%

Europe, Middle East and Africa

85%

Latin America

90%

North America

87%

Online surveys rank as the most used quantitative method among market research professionals with 85% of respondents who claim they use this method regularly, followed by mobile surveys (47%) and proprietary panels (32%) – Statista

Quantitative Method

Share of Researchers Who Use Regularly

Online surveys

85%

Mobile surveys

47%

Proprietary panels

32%

Online communities

26%

CATI

13%

Face-to-face

12%

CAPI

10%

Automated measures/people meters

7%

Mail

4%

IVR

4%

Neuroscience measurements

4%

Biometrics

3%

Other quantitative techniques

16%

Among qualitative methods, online in-depth interviews with webcams (34%) and online focus groups with webcams (28%) are most commonly used among researchers – Statista

Qualitative Method

Share of Researchers Who Use Regularly

Online IDis with webcams

34%

Online focus groups with webcams

28%

Online communities

28%

Mobile

20%

In person IDIs

16%

In person focus groups

14%

Telephone IDIs

13%

Bulletin board studies

11%

In-store/shopping observations

11%

Chat (text-based) online focus groups

10%

Other qualitative methods

10%

Chat (text-based) online IDIs

7%

Monitoring blogs

7%

Automated interviewing via AI systems

5%

Telephone focus groups

3%

By survey type, nearly half of market research spending (43.8%) was used on customer satisfaction (16.4%), market measurement (15%), user experience surveys (12.4%) – Statista

Survey Method

Share of Spending

CRM Systems/Customer Satisfaction

16.4%

Market measurement

15%

User experience

12.4%

Usage and behavioral studies

11%

(Media) Audience research

10.3%

New product/service development

9.3%

Opinion survey/polling

5%

Omnibus/cost-sharing surveys

5%

Advertising/brand tracking

4.6%

Employee satisfaction

2.5%

Ad pre-test

1.9%

Business-to-business research

1.8%

Market modeling

1.4%

Non-profit research

0.9%

Mystery Shopping

0.5%

Other

1.9%

Nearly 6-in-10 (57.2%) survey responses worldwide were submitted from mobile devices in Q3 2023. That’s a slight increase from 56.2% in Q3 2021 – SurveyMonkey

Date

Mobile

Non-Mobile

Q4 2020

52.0%

44.7%

Q1 2021

52.1%

44.7%

Q2 2021

53.0%

43.8%

Q3 2021

56.2%

41.1%

Q4 2021

55.3%

41.6%

Q1 2022

55.0%

41.5%

Q2 2022

56.1%

40.6%

Q3 2022

58.2%

38.7%

Q4 2022

56.9%

39.9%

Q1 2023

54.7%

40.4%

Q2 2023

55.1%

40.3%

Q3 2023

57.2%

38.6%

In the US mobile survey responses accounted for 47.6% of all survey responses (vs. 48.2% on non-mobile devices) in Q3 2023 – SurveyMonkey

Date

Mobile

Non-Mobile

Q4 2020

39.7%

55.7%

Q1 2021

40.7%

54.9%

Q2 2021

39.7%

56.0%

Q3 2021

41.8%

54.5%

Q4 2021

41.8%

53.5%

Q1 2022

42.0%

52.9%

Q2 2022

43.4%

51.8%

Q3 2022

44.7%

51.3%

Q4 2022

43.9%

51.4%

Q1 2023

43.7%

50.2%

Q2 2023

45.1%

49.7%

Q3 2023

47.6%

48.2%

On average, online surveys hosted on one of the platforms included 11 questions in 2023. That’s down from 11.8 questions in 2019 – SurveyMonkey

Year

Average Number of Questions

2010

12.1

2011

12.0

2012

11.8

2013

11.5

2014

11.5

2015

13.0

2016

13.1

2017

13.2

2018

12.2

2019

11.8

2020

10.2

2021

10.5

2022

10.7

2023

11.0

More than half (54%) of online surveys feature 5 or fewer questions per page – SurveyMonkey

Number of Questions Per Survey Page

Share of Surveys

1 or fewer

7%

>1 to 2

14%

>2 to 3

13%

>3 to 4

11%

>4 to 5

9%

>5 to 6

7%

>6 to 7

6%

>7 to 8

5%

>8 to 9

4%

>9 to 10

5%

More than 10

18%

More than 6-in-10 (62%) researchers say that their “company depends on their research and insights significantly” – Qualtrics

A majority of researchers have reported an increase in their budgets allocated for customer experience (CX) research (53%), consumer trends (52%), UX research (51%), qualitative research (51%) and brand strategy (50%) – Qualtrics

3. AI in Market Research Statistics

AI is disrupting nearly every industry and job function. Market research is no exception and there are various AI use cases to apply in the everyday work of market researchers. We’ll explore the latest stats on AI adoption rate among market researchers in this section.

Around 47% of researchers worldwide claim that they use AI regularly in their market research activities – Qualtrics

The share of AI adopters among researchers varies depending on the region, with the highest usage in Asia-Pacific & Japan (58%) and the lowest in North America (39%) – Qualtrics

Region

Share of Researchers Who Regularly Use AI

Asia-Pacific and Japan

58%

Europe, Middle East and Africa

51%

Latin America

51%

North America

39%

The vast majority (73%) of researchers worldwide claim they’re “very confident” or “extremely confident” on how to apply AI to their market research activities – Qualtrics

Around 1-in-4 researchers state they’re concerned about AI impact outpacing their personal or team skills – Qualtrics

Conclusion

That’s it for my list of market research statistics.

While market research has been around for a while, it has been undergoing constant transformation. It will be interesting to see how AI impacts market research projects.

We update this list of statistics from time to time so feel free to check it later for new insights.

The post 19 Key Market Research Statistics appeared first on Backlinko.