Consumer behavior throughout 2025 made one thing clear: CPG marketing is not about being everywhere. It’s about showing up in the right places, with the right message, at the right moment.

Shoppers now move fluidly between social media, AI-powered search, in-store shelves, Amazon, Walmart, and direct-to-consumer checkout flows. Millennials and Gen Z expect brands to understand their values, pricing expectations, and needs in real time. That shift is forcing CPG marketers to rethink everything from attribution to influencer spend to how AI tools fit into the broader marketing strategies mix.

Here are five CPG marketing trends shaping 2026 and how we recommend budgeting for them to support both growth and long-term brand equity.

Trend 1: The Death of the Awareness-Only Social Media Strategy

Awareness-only social strategies are struggling because attention is no longer scarce. It’s fragmented.

Between TikTok, Instagram, LinkedIn, retail media networks, and AI-driven discovery tools, consumers are flooded with content. A single impression rarely changes purchase decisions, especially in crowded consumer packaged goods categories like food and beverage or wellness.

When social media focuses only on reach, CPG brands often end up doing two risky things:

Introducing high-intent shoppers to competitors’ algorithms by driving awareness traffic without controlling the next touchpointPaying for impressions without learning anything about consumer behavior

What is working now is utilizing social as a full-funnel channel that supports decision-making, not just visibility.

Strong CPG social strategies in 2026 focus on:

Content formats that invite interaction, not passive scrollingMessaging that answers real consumer needs and objectionsEvaluating results tied to mid-funnel metrics, not just impressions

Amazon’s data shows that 94% of shoppers inspired by creator content visit Amazon to complete a purchase, and adding Amazon Ads to social strategies can drive meaningful full-funnel lifts, including increases in search volume, product views, and add-to-cart events, which supports the idea that social activity can translate into measurable commerce impact.

Which Metrics Actually Matter for CPG Social Attribution?

Likes alone don’t tell you much anymore. CPG brands need signals that show intent, trust, and momentum across touchpoints.

The most useful social metrics in 2026 include:

Comments and shares that show content resonanceMessages and replies that indicate considerationRepeat engagement across multiple formatsTraffic quality flowing into checkout across channels, measured by engagement and conversion signals, not just volume

These metrics help teams connect social media activity to real purchase decisions, even when attribution isn’t perfectly linear. They also feed smarter forecasts when paired with retail and e-commerce data.

Trend 2: Micro-Influencers vs. Performance Marketing

Micro-influencers work when brands understand their role in the funnel. They are not a shortcut to immediate revenue.

Where micro-influencers shine:

Building trust with niche audiencesSupporting sustainability, wellness, or values-driven messagingDiversifying creative formats for paid social and retail mediaWarming audiences before promotions or product launches

Where brands go wrong is treating influencer partnerships like performance ads. Expecting a clean 1:1 return usually leads to disappointment.

The brands seeing ROI use micro-influencers as a brand lever that supports performance later, not a standalone growth hack. That distinction matters when allocating budget across paid social and influencers.

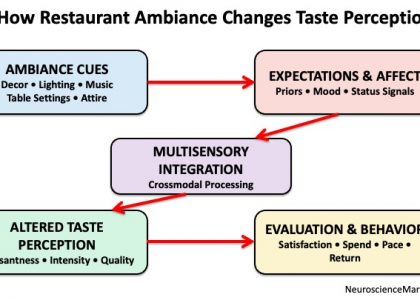

Trend 3: AI Search Is Reshaping Product Discovery

According to The Global Consumer Products Engagement Report, 76% of consumer product marketers believe AI will be essential for engaging new customers. That belief isn’t theoretical. It reflects how quickly product discovery behavior is changing.

Instead of scrolling through traditional search results or social feeds, shoppers now ask AI tools direct questions like:

Which food and beverage brands prioritize sustainability?What private label alternatives match this ingredient list?Which wellness products align with my values and budget?

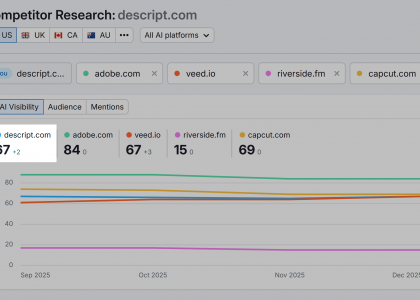

These tools pull answers from a mix of structured content, product data, reviews, and brand signals. That shift is pushing CPG marketers to think beyond SEO alone and start accounting for Generative Engine Optimization (GEO), how brands show up in AI-generated responses, not just ranked links.

GEO doesn’t replace SEO. It builds on it.

CPG brands preparing for this shift are:

Structuring content to answer direct product, use-case, and value-based questionsAligning messaging across social, retail, and site content so AI tools see consistencyTreating AI-driven discovery as part of the broader omnichannel buying journey

As AI tools continue to influence how shoppers compare products and narrow options, visibility inside those responses becomes a competitive advantage, especially in crowded categories.

For brands trying to understand how they currently show up in AI-powered discovery, tools like V9’s GEO Grader can help identify gaps in visibility, messaging alignment, and content structure before those gaps show up in lost demand.

Trend 4: First-Party Data Becomes Non-Negotiable

CPG brands can’t rely on third-party tracking to carry attribution or personalization anymore. Signals like third-party cookies, platform-reported conversions, or modeled lookback windows don’t fully capture how consumers move between social, marketplaces, and in-store purchase paths.

Effective first-party data strategies include:

Strong email and SMS capture tied to value exchangeLoyalty programs connected to e-commerce and DTCRetailer partnerships that provide anonymized insightsClean data flows between paid media, CRM, and analytics

First-party data fuels better pricing tests, smarter messaging, and more accurate forecasting across the supply chain and media planning.

Trend 5: Omnichannel Is the Baseline Expectation

Consumer behavior throughout 2025 made one thing clear: CPG marketing is not about being everywhere. It’s about showing up intentionally in the places that actually influence purchase decisions, with the right message, at the right moment.

They might discover a product on TikTok, research it through AI-powered search, check reviews on Amazon, and buy it in-store at Walmart. Brands that only show up in one place lose momentum fast.

Strong omnichannel strategies in the CPG industry connect:

Direct-to-consumer experiencesRetailers and retail mediaAmazon and marketplace presenceIn-store visibility and promotions

Consistency across these touchpoints builds trust and protects brand equity. Disconnected messaging erodes it.

How Should CPG Brands Budget for Brand and Performance in 2026?

Balancing short-term revenue and long-term growth requires clearer guardrails.

A practical budgeting framework we see working looks like this:

40–50% toward performance-driven channelsPaid socialRetail mediaAmazon ads

30–40% toward brand-buildingInfluencer partnershipsOrganic socialSEO and GEO programs that support discoverability across search, AI tools, and retail research paths

10–20% toward experimentationNew formatsAI tools and automationEmerging platforms

Budgets should flex based on seasonality, inventory, and supply chain realities, but the mix matters more than chasing every new marketing trend.

Key Takeaways for CPG Marketers Planning 2026

Awareness alone won’t drive growthInfluencers support performance, not replace itAI-powered discovery is already shaping purchase decisionsFirst-party data enables smarter decision-makingOmnichannel consistency protects brand equity

The brands that win will operate with clear intent, aligning brand and performance across an ever-evolving landscape.

Build a Smarter CPG Growth Plan for 2026

The CPG brands pulling ahead in 2026 aren’t chasing every new channel or AI tool. They’re making disciplined decisions about where to invest, what to test, and what actually drives purchase decisions across retail, e-commerce, and social.

If you’re weighing brand versus performance, questioning how AI-driven discovery fits into your mix, or trying to make sense of an increasingly complex omnichannel ecosystem, that’s where we come in.

Connect with a V9 CPG expert to pressure-test your marketing strategy, gut-check your budget, and map a clearer path to sustainable growth.

Frequently Asked Questions About CPG Marketing Trends and Strategy

1. What Are the Biggest CPG Marketing Trends for 2026?

AI-driven discovery, stronger attribution, omnichannel expectations, first-party data strategies, and more disciplined influencer spend are shaping the year ahead.

2. How Should CPG Brands Use AI in Marketing?

Artificial intelligence supports search visibility, content structuring, automation, forecasting, and personalization. It works best when built into existing workflows, informing strategy, messaging, and measurement, rather than being used as a standalone tool.

3. Are Influencers Still Relevant for CPG Brands?

Yes, when used for trust and brand building. Influencer spend works best alongside paid social and retail media, not as a standalone growth engine.

4. How Important Is Omnichannel for Consumer Packaged Goods?

Critical. Consumers expect brands to show up consistently across social media, e-commerce, Amazon, retailers, and in-store experiences.

5. What Metrics Matter Most for CPG Digital Marketing?

Engagement quality, repeat interactions, traffic that converts, and signals that reflect real consumer behavior across channels.